Trend of Chinese trademarks at EUIPO| 欧盟知识产权局关于中国商标的发展趋势

Translated by Peggy Shi

On February 24th, 2021, the European Intellectual Property Office (EUIPO) published the report entitled “China EUTM and RCD Focus” which focused the attention on 10 years of China trademark (TM) and registered community design (RCD) filings in the European Union.

The report also makes few considerations on the impact that the 2020 Covid-19 pandemic had in the intellectual property community.

Briefly, the European Union Trade Mark (EUTM) application filings from China, experienced a remarkable growth from 2010 to 2019, with an average rate of 33.2% and an overall growth rate of 1,027.9%. While, when comparing the 2019 and 2010 filing volumes, more than 63,000 EUTM filings, including over 116,500 goods and services classes, were filed by more than 47,000 individual applicants.

Despite the Covid-19 pandemic, 2020 was a powerful year for Chinese trademark filings. In fact, the Chinese filing increased sharply of the 88% in 2020 compared to the past year 2019. A significant but less important rate is found in RCD filing with only 19%.

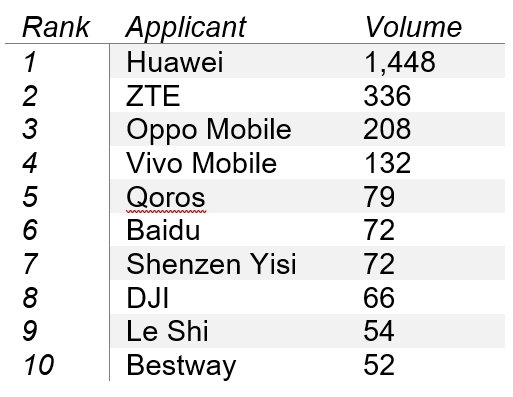

It is reported that the Top 10 EUTM applicants from China during the period in question are all large enterprises operating in various industrial and commercial sectors, such as: consumer electronics; telecommunications equipment, systems and services; automotive design and manufacturing; Internet-related services and products.

Huawei is the company commands the chart being responsible for more than 50% of the collective Top 10 filing volume. ZTE (telecommunications equipment, networks and mobile devices) occupies the second position in the ranking, followed in third by Oppo Mobile (consumer electronics and mobile communications).

However, the Top 10 applicants collectively represent only 4% of overall EUTM filings from China, which are overwhelmingly filed by small and medium enterprises (SMEs).

Eventually, these data may be indicators that China’s efforts to expand its ownership of IP, beyond a few leading companies, is showing success. However, despite the overall TM filings growth, filings using the Madrid system dropped from 38% to 14%; but it showed familiarity with the European system from the Chinese applicants.

Apart from trademark or design filings, 2019 indicated the absolute grounds objection rate for EUTMs with Chinese applicants, which was around 3% compared to the overall rate of 7%. Also, the Chinese classification deficiency rate was 2% compared to a 14% rate overall. The only area where the rejection rate was higher for Chinese applicants, compared to the EU average, was in filing the so called “formality deficiencies” (3.7% vs. 2.2%).

The pandemic did not produce major changes regarding the basic composition and share distribution of the Top 10 overall EUTM and Direct RCD filing classes in 2020, although certain variations were most likely driven by the health crisis.

As the report declares, China’s preponderance on the EUTM and Direct RCD filings during 2020 is quite evident and was clearly decisive in sustaining the overall growth dynamic for the EUIPO’s main products even under extremely difficult circumstances.

The Office will closely monitor the evolution of filing volumes from China and other countries in order to properly adjust strategies and capabilities aimed on continuing to meet the needs of its users with excellent quality and timeliness.

2021年2月24日,欧洲知识产权局(EUIPO)发布了欧盟商标和注册式欧盟外观设计中国专题报告,该报告聚焦于十年内中国商标(TM)和注册式欧盟外观设计(RCD)在欧盟的备案。

该报告也考虑到了2020年新冠肺炎的大流行对知识产权界造成的影响。

简而言之,中国提交的欧盟商标(EUTM)申请在2010年至2019年期间经历了显著的增长,平均增长率为33.2%,总体增长率为1,027.9%。而在比较2019年和2010年的申请量时,有超过47,000名个人申请人提交了超过63,000份欧盟商标申请,其中包括116,500多个商品和服务类别。

尽管有新冠肺炎的大流行,2020年对中国的商标申请而言依旧是强而有力的一年。事实上,同去年(2019年)相比,2020年中国的商标申请量大幅增长88%。而注册式欧盟外观设计的增长率仅为19%,虽然该增长也很显著,但相比而言就没有那么重要了。

报告显示,上述期间内来自中国的欧盟商标申请者前十名均为各工商领域的大型企业,例如消费类电子产品;电信设备、系统和服务;汽车设计与制造;互联网相关服务和产品。

华为作为榜首,在前十名企业的全部申报量中占据了50%以上的份额。中兴通讯(电信设备、网络和移动设备)位列第二,紧接着是排名第三的OPPO手机(消费类电子产品和移动通信)。

然而,排名前十的申请者总共只占了中国欧盟商标申请总量的4%,绝大多数的申请是由中小企业(SMEs)提交的。

最后,这些数据可能表明,中国正在把知识产权的所有权扩大到龙头企业之外,而这种努力正在见效。然而,尽管商标申请总体在增长,使用马德里系统提交的申请却从38%降到了14%,不过这也说明中国申请人对欧洲的系统比较熟悉。

2019年的部分商标和外观设计申请表明,约3%的中国申请人在申请欧盟商标注册时存在绝对注册障碍,相比之下,绝对注册障碍的总体比例为7%。此外,中国申请人存在分类缺陷的比例是2%,该数据的总体比例为14%。与欧盟的均值相比,中国申请人被拒率唯一较高的领域是申请中所谓的“形式缺陷”。(3.7%vs. 2.2%)

尽管某些变化很可能是由健康危机驱动的,但在2020年中,新冠肺炎的流行并没有对欧盟商标总体排名前十和注册式欧盟外观设计直接申报类别的基本构成和份额分布造成重大影响。

正如报告所指出的,2020年中国在欧盟商标和注册式欧盟外观设计直接申报方面的优势十分明显,并且即使是在极为困难的情况下,依旧对维持欧洲知识产权局主要产品的总体增长动力起到了决定性作用。

我局将会密切监测来自中国和其他各国备案数量的演变,以便适当调整战略和能力,继续高质量、及时的满足用户需求。